colorado refinance insights and highlights

What a refinance can do

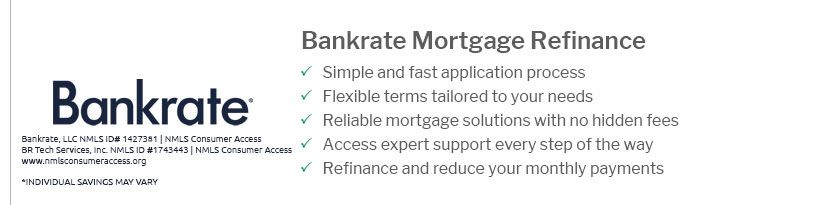

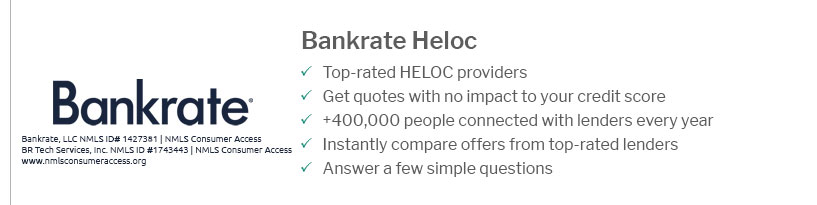

Refinancing in Colorado can lower your rate, shorten your term, or tap equity for projects without derailing long-term plans. From Front Range suburbs to high-country condos, markets move fast; a well-timed refi can add payment stability while freeing cash flow for savings or repairs.

Key features to weigh

Compare fixed versus adjustable terms, ask about rate buydowns, and map closing costs to a realistic break-even date. Lender overlays, credit score tiers, and recent home-value swings-especially in resort areas-can shape your approval and pricing. Don’t overlook wildfire insurance requirements or HOA rules that affect condo eligibility.

- Purpose: rate-and-term, cash-out, or debt consolidation.

- Costs: origination, appraisal, title; seek lender credits.

- Timeline: typical 25–45 days, longer in peak seasons.

- Appraisal: mountain access and winter weather can delay.

- Taxes: interest is not always deductible; consult a pro.

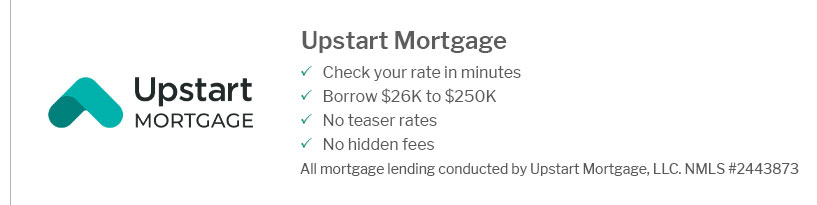

Getting started

Gather income docs, price multiple quotes on the same day, and consider a lock with a float-down. A local loan officer who knows altitude effects, short-term rentals, and second-home rules can streamline underwriting.